Box 8 And 9 Vat Return Brexit . Web this guidance was withdrawn on 29 january 2021. Web the advice given to businesses. This guidance only applies to goods and services sold to the eu from. The new labelling is, total value of dispatches of goods and related costs (excluding vat) from northern ireland to eu member states.”. Web following the ending of the uk’s brexit transition period on 31 december 2021, the standard value added tax return has undergone. Web 10 rows box 8 has been amended, the old labelling was, “total value of all supplies of goods and related costs, excluding any vat, to other ec member states.”. Web the hmrc making tax digital policy team have provided clarification on the use of box 8 on the uk vat return. On the 8th april 2021 hmrc updated the wording and the advice notes on some but not all of the.

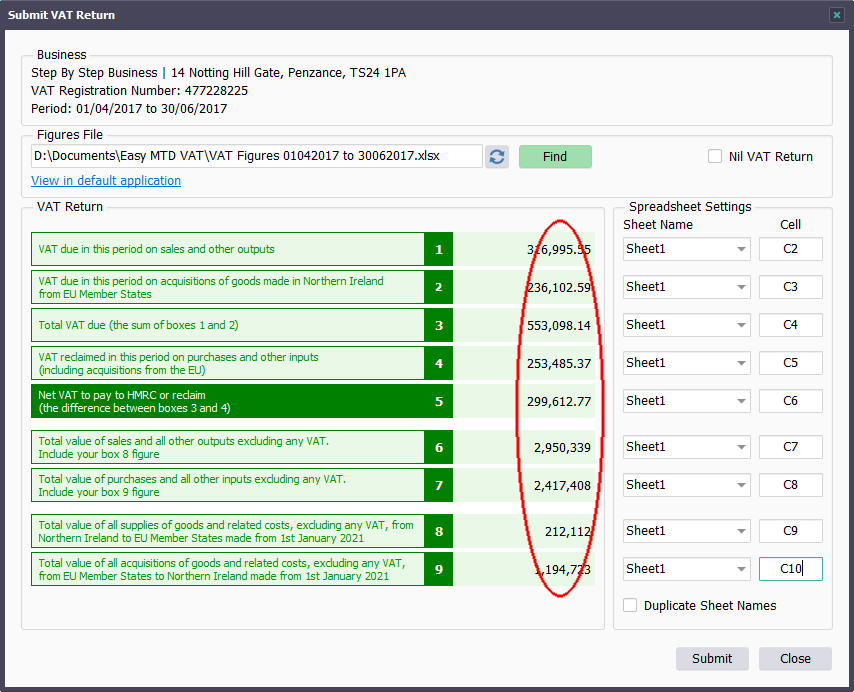

from easymtdvat.com

This guidance only applies to goods and services sold to the eu from. Web the hmrc making tax digital policy team have provided clarification on the use of box 8 on the uk vat return. On the 8th april 2021 hmrc updated the wording and the advice notes on some but not all of the. Web this guidance was withdrawn on 29 january 2021. Web 10 rows box 8 has been amended, the old labelling was, “total value of all supplies of goods and related costs, excluding any vat, to other ec member states.”. The new labelling is, total value of dispatches of goods and related costs (excluding vat) from northern ireland to eu member states.”. Web following the ending of the uk’s brexit transition period on 31 december 2021, the standard value added tax return has undergone. Web the advice given to businesses.

StepByStep Guide

Box 8 And 9 Vat Return Brexit This guidance only applies to goods and services sold to the eu from. On the 8th april 2021 hmrc updated the wording and the advice notes on some but not all of the. Web the advice given to businesses. The new labelling is, total value of dispatches of goods and related costs (excluding vat) from northern ireland to eu member states.”. Web following the ending of the uk’s brexit transition period on 31 december 2021, the standard value added tax return has undergone. This guidance only applies to goods and services sold to the eu from. Web this guidance was withdrawn on 29 january 2021. Web the hmrc making tax digital policy team have provided clarification on the use of box 8 on the uk vat return. Web 10 rows box 8 has been amended, the old labelling was, “total value of all supplies of goods and related costs, excluding any vat, to other ec member states.”.

From support.khaoscontrol.com

018897 UK Vat EU sales figures Box 6 and Box 8 Khaos Control Wiki Box 8 And 9 Vat Return Brexit Web this guidance was withdrawn on 29 january 2021. Web 10 rows box 8 has been amended, the old labelling was, “total value of all supplies of goods and related costs, excluding any vat, to other ec member states.”. On the 8th april 2021 hmrc updated the wording and the advice notes on some but not all of the. Web. Box 8 And 9 Vat Return Brexit.

From vitaltax.uk

VitalTax MTD for VAT Excel Bridging Software Box 8 And 9 Vat Return Brexit Web the advice given to businesses. This guidance only applies to goods and services sold to the eu from. Web this guidance was withdrawn on 29 january 2021. On the 8th april 2021 hmrc updated the wording and the advice notes on some but not all of the. Web following the ending of the uk’s brexit transition period on 31. Box 8 And 9 Vat Return Brexit.

From support.freeagent.com

How to adjust boxes 1 and 4 of your VAT return FreeAgent Box 8 And 9 Vat Return Brexit Web 10 rows box 8 has been amended, the old labelling was, “total value of all supplies of goods and related costs, excluding any vat, to other ec member states.”. On the 8th april 2021 hmrc updated the wording and the advice notes on some but not all of the. Web the hmrc making tax digital policy team have provided. Box 8 And 9 Vat Return Brexit.

From goselfemployed.co

How to Complete Your First VAT Return Box 8 And 9 Vat Return Brexit Web following the ending of the uk’s brexit transition period on 31 december 2021, the standard value added tax return has undergone. This guidance only applies to goods and services sold to the eu from. Web this guidance was withdrawn on 29 january 2021. Web the advice given to businesses. The new labelling is, total value of dispatches of goods. Box 8 And 9 Vat Return Brexit.

From www.easify.co.uk

Easify Help Finance Doing a VAT Return Box 8 And 9 Vat Return Brexit Web 10 rows box 8 has been amended, the old labelling was, “total value of all supplies of goods and related costs, excluding any vat, to other ec member states.”. This guidance only applies to goods and services sold to the eu from. Web the hmrc making tax digital policy team have provided clarification on the use of box 8. Box 8 And 9 Vat Return Brexit.

From www.aihr.com

9 Box Grid A Practitioner’s Guide [FREE Template] AIHR Box 8 And 9 Vat Return Brexit This guidance only applies to goods and services sold to the eu from. Web this guidance was withdrawn on 29 january 2021. The new labelling is, total value of dispatches of goods and related costs (excluding vat) from northern ireland to eu member states.”. On the 8th april 2021 hmrc updated the wording and the advice notes on some but. Box 8 And 9 Vat Return Brexit.

From goselfemployed.co

How to Complete Your First VAT Return Box 8 And 9 Vat Return Brexit The new labelling is, total value of dispatches of goods and related costs (excluding vat) from northern ireland to eu member states.”. This guidance only applies to goods and services sold to the eu from. Web this guidance was withdrawn on 29 january 2021. Web following the ending of the uk’s brexit transition period on 31 december 2021, the standard. Box 8 And 9 Vat Return Brexit.

From www.attendancebot.com

Manage employees better with the 9 box grid AttendanceBot Box 8 And 9 Vat Return Brexit Web the hmrc making tax digital policy team have provided clarification on the use of box 8 on the uk vat return. On the 8th april 2021 hmrc updated the wording and the advice notes on some but not all of the. This guidance only applies to goods and services sold to the eu from. Web the advice given to. Box 8 And 9 Vat Return Brexit.

From www.lexology.com

Overview of the VAT impacts of Brexit Lexology Box 8 And 9 Vat Return Brexit Web 10 rows box 8 has been amended, the old labelling was, “total value of all supplies of goods and related costs, excluding any vat, to other ec member states.”. This guidance only applies to goods and services sold to the eu from. Web this guidance was withdrawn on 29 january 2021. Web the hmrc making tax digital policy team. Box 8 And 9 Vat Return Brexit.

From tax.gov.ae

Federal Tax Authority Filing VAT Returns And Making Payments Box 8 And 9 Vat Return Brexit On the 8th april 2021 hmrc updated the wording and the advice notes on some but not all of the. Web the hmrc making tax digital policy team have provided clarification on the use of box 8 on the uk vat return. Web 10 rows box 8 has been amended, the old labelling was, “total value of all supplies of. Box 8 And 9 Vat Return Brexit.

From accountantsbox.com

THINGS TO KNOW for VAT Return filing in uae UAE VAT Retuns Box 8 And 9 Vat Return Brexit Web following the ending of the uk’s brexit transition period on 31 december 2021, the standard value added tax return has undergone. The new labelling is, total value of dispatches of goods and related costs (excluding vat) from northern ireland to eu member states.”. Web the advice given to businesses. Web the hmrc making tax digital policy team have provided. Box 8 And 9 Vat Return Brexit.

From support.freeagent.com

How to adjust boxes 1 and 4 of your VAT return FreeAgent Box 8 And 9 Vat Return Brexit Web the hmrc making tax digital policy team have provided clarification on the use of box 8 on the uk vat return. Web this guidance was withdrawn on 29 january 2021. Web 10 rows box 8 has been amended, the old labelling was, “total value of all supplies of goods and related costs, excluding any vat, to other ec member. Box 8 And 9 Vat Return Brexit.

From community.quickfile.co.uk

VAT Returns Guide VAT QuickFile Box 8 And 9 Vat Return Brexit Web this guidance was withdrawn on 29 january 2021. Web the hmrc making tax digital policy team have provided clarification on the use of box 8 on the uk vat return. Web 10 rows box 8 has been amended, the old labelling was, “total value of all supplies of goods and related costs, excluding any vat, to other ec member. Box 8 And 9 Vat Return Brexit.

From inlandrevenue.finance.gov.bs

Tax Compliance Certificate Box 8 And 9 Vat Return Brexit This guidance only applies to goods and services sold to the eu from. Web the hmrc making tax digital policy team have provided clarification on the use of box 8 on the uk vat return. Web 10 rows box 8 has been amended, the old labelling was, “total value of all supplies of goods and related costs, excluding any vat,. Box 8 And 9 Vat Return Brexit.

From quickbooks.intuit.com

VAT Box 6 Box 8 And 9 Vat Return Brexit This guidance only applies to goods and services sold to the eu from. Web the advice given to businesses. Web the hmrc making tax digital policy team have provided clarification on the use of box 8 on the uk vat return. The new labelling is, total value of dispatches of goods and related costs (excluding vat) from northern ireland to. Box 8 And 9 Vat Return Brexit.

From www.lupon.gov.ph

Box Grid Excel Template Free Download Succession Planning lupon.gov.ph Box 8 And 9 Vat Return Brexit The new labelling is, total value of dispatches of goods and related costs (excluding vat) from northern ireland to eu member states.”. Web this guidance was withdrawn on 29 january 2021. Web 10 rows box 8 has been amended, the old labelling was, “total value of all supplies of goods and related costs, excluding any vat, to other ec member. Box 8 And 9 Vat Return Brexit.

From www.naauk.org

An exclusive insight into important VAT changes postBrexit NAAUK Box 8 And 9 Vat Return Brexit The new labelling is, total value of dispatches of goods and related costs (excluding vat) from northern ireland to eu member states.”. Web 10 rows box 8 has been amended, the old labelling was, “total value of all supplies of goods and related costs, excluding any vat, to other ec member states.”. Web the hmrc making tax digital policy team. Box 8 And 9 Vat Return Brexit.

From help.eventbrite.com

How to set up country VAT exemptions for... Eventbrite Help Center Box 8 And 9 Vat Return Brexit Web the advice given to businesses. Web 10 rows box 8 has been amended, the old labelling was, “total value of all supplies of goods and related costs, excluding any vat, to other ec member states.”. Web the hmrc making tax digital policy team have provided clarification on the use of box 8 on the uk vat return. The new. Box 8 And 9 Vat Return Brexit.